Crystal Ball Blues: Conquering the Financial Forecasting Challenge

By: A Staff Writer

Updated on: Jul 29, 2024

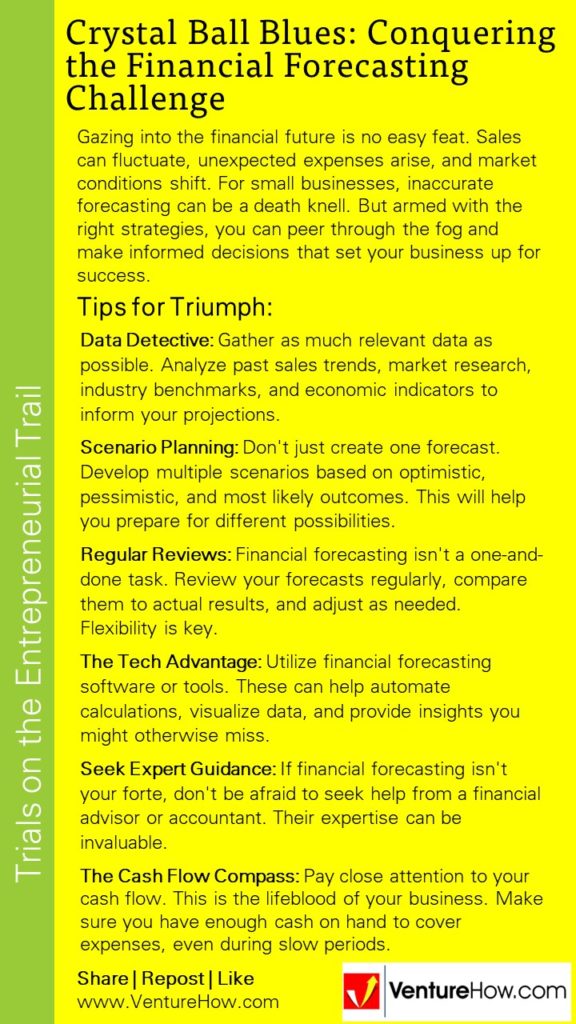

Gazing into the financial future is no easy feat. Sales can fluctuate, unexpected expenses arise, and market conditions shift. For small businesses, inaccurate forecasting can be a death knell. But armed with the right strategies, you can peer through the fog and make informed decisions that set your business up for success.

Tips for Triumph:

Data Detective: Gather as much relevant data as possible. Analyze past sales trends, market research, industry benchmarks, and economic indicators to inform your projections.

Scenario Planning: Don’t just create one forecast. Develop multiple scenarios based on optimistic, pessimistic, and most likely outcomes. This will help you prepare for different possibilities.

Regular Reviews: Financial forecasting isn’t a one-and-done task. Review your forecasts regularly, compare them to actual results, and adjust as needed. Flexibility is key.

The Tech Advantage: Utilize financial forecasting software or tools. These can help automate calculations, visualize data, and provide insights you might otherwise miss.

Seek Expert Guidance: If financial forecasting isn’t your forte, don’t be afraid to seek help from a financial advisor or accountant. Their expertise can be invaluable.

The Cash Flow Compass: Pay close attention to your cash flow. This is the lifeblood of your business. Make sure you have enough cash on hand to cover expenses, even during slow periods.

Accurate financial forecasting is a critical skill for small business success. By utilizing data, creating multiple scenarios, regularly reviewing projections, and seeking expert guidance when needed, you can make informed decisions that drive your business forward.