The Exit Strategy: Planning Your Business’s Grand Finale

By: A Staff Writer

Updated on: Jul 29, 2024

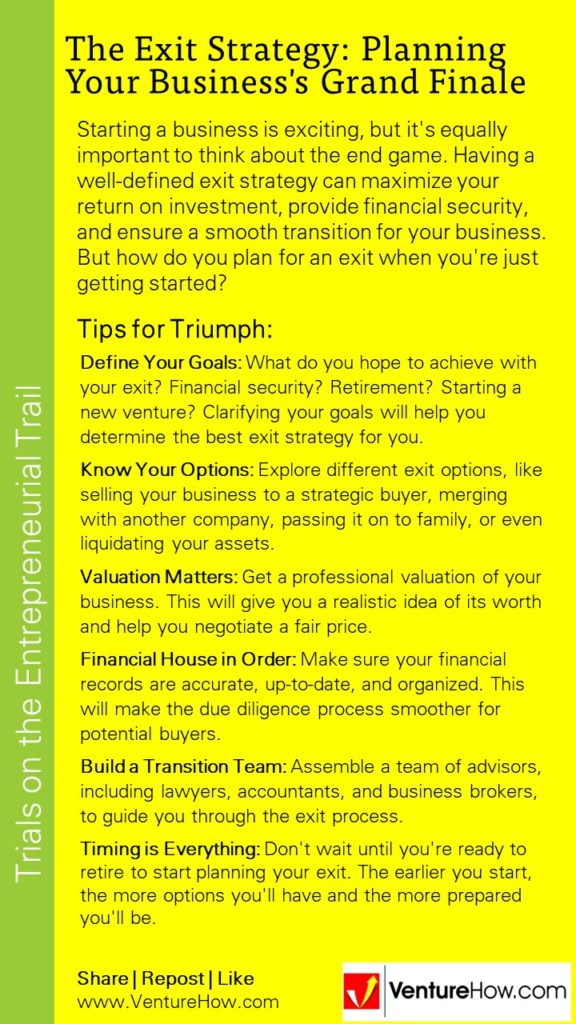

Starting a business is exciting, but it’s equally important to think about the end game. Having a well-defined exit strategy can maximize your return on investment, provide financial security, and ensure a smooth transition for your business. But how do you plan for an exit when you’re just getting started?

Tips for Triumph:

Define Your Goals: What do you hope to achieve with your exit? Financial security? Retirement? Starting a new venture? Clarifying your goals will help you determine the best exit strategy for you.

Know Your Options: Explore different exit options, like selling your business to a strategic buyer, merging with another company, passing it on to family, or even liquidating your assets.

Valuation Matters: Get a professional valuation of your business. This will give you a realistic idea of its worth and help you negotiate a fair price.

Financial House in Order: Make sure your financial records are accurate, up-to-date, and organized. This will make the due diligence process smoother for potential buyers.

Build a Transition Team: Assemble a team of advisors, including lawyers, accountants, and business brokers, to guide you through the exit process.

Timing is Everything: Don’t wait until you’re ready to retire to start planning your exit. The earlier you start, the more options you’ll have and the more prepared you’ll be.

Exit planning is not just for businesses nearing retirement. It’s a crucial aspect of business strategy that should be considered from the beginning. By defining your goals, exploring your options, and preparing your business for a smooth transition, you can maximize your return on investment and ensure your business’s legacy.