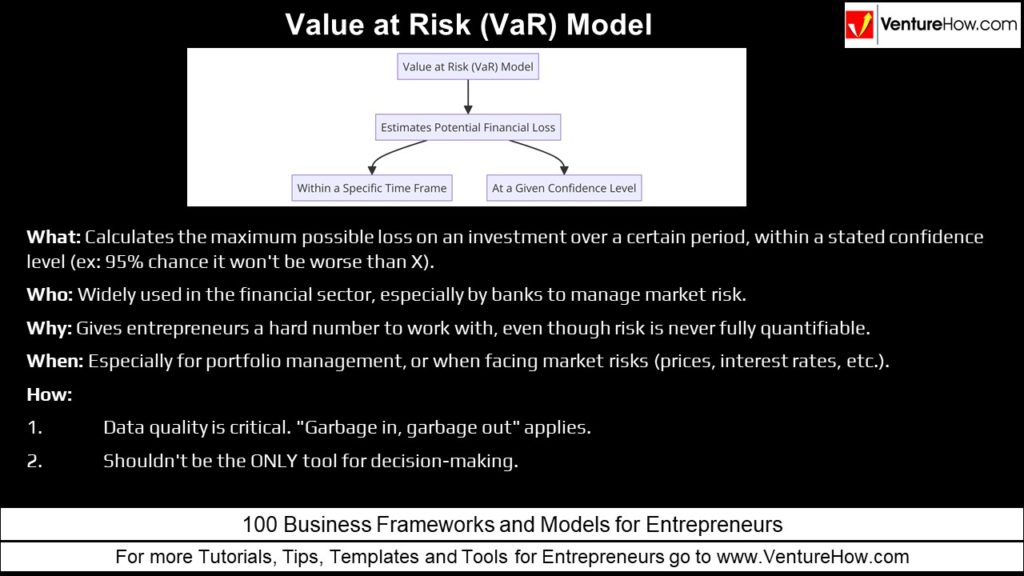

Value at Risk (VaR) Model

By: A Staff Writer

Updated on: Jul 19, 2024

What: Calculates the maximum possible loss on an investment over a certain period, within a stated confidence level (ex: 95% chance it won’t be worse than X).

Who: Widely used in the financial sector, especially by banks to manage market risk.

Why: Gives entrepreneurs a hard number to work with, even though risk is never fully quantifiable.

When: Especially for portfolio management, or when facing market risks (prices, interest rates, etc.).

How:

-

- Data quality is critical. “Garbage in, garbage out” applies.

- Shouldn’t be the ONLY tool for decision-making.